are electric cars tax deductible uk

By choosing an electric car your company can claim a 100 first-year allowance on the cost of the vehicle provided it is purchased new. It brings your income tax rate to effectively 60.

2023 Is Supposed To Be The Year Of The Electric Vehicle Now Is The Time To Invest Protocol

If your business purchases a new and unused electric car you get full tax relief in the year of purchase.

. Electric cars are able to deduct entirely the cost of being sold from their pre-tax profits. CAPITAL ALLOWANCES ON ELECTRIC CARS. In March 2021 the government reduced the plug-in car grant PICG for new EVs from 3000 to 2500 with the threshold for qualifying purchases also falling from 50000 to 35000.

Use the company car tax calculator to calculate the company car tax due for any electric vehicle or. The grant offers a discount of up to 3000 on the price of an electric car and 350 on the cost of installing a charger. For example a vehicle costing 36000 with CO2 levels of 32 gkm and an electric only range of between 30 and 39 miles will have a benefit rate of 12 in 2021-22 and be classified as having a taxable benefit of 4320.

Find out whether you or your employee need to pay tax or National Insurance for charging an electric car. Charge for battery electric cars. For cars with emissions below 50g CO2km the percentage will be based on the electric range of the vehicle and the registration date.

There have also been reductions for electric hybrids depending on their electric-only range. Are electric cars tax-deductible in the UK. Privately owned electric cars.

The tax rules for ultra low emission company cars are set to change from 6 April 2020 making the purchase of an electric vehicle potentially more attractive for a. This is an enhanced rate of capital allowances which would reduce your companys taxable profits for the. Financial Year 202122 sees pure-electric models rated at 1 for BIK and these rates only climb to 2 for FY 2223 and 2324.

For tax year 202122 this increased to 1 and then increases to 2 for years 202223 to 202425. But all electric cars are now exempt from all VED costs no matter their original list price. However for an electric car the entire 30k can be used as a tax deductible cost thereby reducing your corporation tax bill by 5700 in year 1.

Before this date electric vehicles costing more than 40000 were liable for an annual road-tax surcharge the first five times the tax was renewed. For tax year 202021 the percentage used to calculate the benefit on fully electric cars with zero emissions was 0. However for an electric car the entire 30k can be used as a tax deductible cost thereby reducing your corporation tax bill by 5700 in year 1.

Where the employee uses his or her own electric car for business journeys the company can pay the normal tax-free mileage allowance to the individual of 45p per mile for the first 10000 miles driven in the year with additional business miles reimbursed at 25p per mile. Add that to the other handy benefits that come with driving an electric vehicle EV and making the switch to electric might just be a smart cost-saving exercise. This page is also available in Welsh Cymraeg.

BMW 320d M Sport Auto. By choosing a tesla car your business can claim a 100 year one deduction for the cost of the vehicle. This compares very favourably to non-electric cars which receive only 6 570 or 18 1710 relief in year 1 depending on their CO 2 emissions.

In addition 130 relief is available for installing. Therefore there is a significant 1st year tax saving to be made by investing in an electric car or van. Unlike petrol and diesel cars electric cars qualify for 100 first year allowances.

Grants loans scotland across the uk grants of up to 3000 are available towards the purchase of a new electric car or one that was an ex demonstrator less than. Annual BIK tax payments are a percentage of that taxable value and depend on your income tax rate. However for an electric car the entire 30k can be used as a tax deductible cost thereby reducing your corporation tax bill by 5700 in year 1.

The rules were changed again in April 2020 albeit to a lesser degree. It came as a surprise to many when a scheme that aims to make electric vehicles EVs more affordable was cut. There are three bands.

So tax relief for leasing an electric car is given each year depending on the cost and business use contrasted with outright purchase which provides an initial and one-off tax deduction. If an electric car has CO2 with less than 50gkm of emissions can also qualify for 100 first-year capital allowances. If the car is leased solely for business purposes then VAT is fully deductible however if there is any personal use then only 50 VAT is deductible.

Some types of vehicle are exempt from vehicle tax. You can also check if your employee is eligible for tax relief. Summary of Electric Car Tax Benefits In his March 2020 Budget Chancellor of the Exchequer Rishi Sunak confirmed that motorists buying electric cars would continue to benefit from the Plug-In Car Grant to 2022-2023 but it would reduce from 3500 to 3000 and cars costing 50000 or more would be excluded.

Electric vehicles are exempt from road tax. For example if you purchase a petrol car for 30000. You must tax your vehicle even if you do not have to pay.

As such company car drivers can save thousands of pounds a year simply by switching from a diesel model to an EV. No if your electric car is pure battery meaning you have to charge your car it to drive it then its free from Vehicle Excise Duty VED aka. This means its free to tax them.

Buy a 50000 car save 9500 in corporation tax. Because of the tax benefits of electric and hybrid cars this means Tom and the company can potentially save tax and National Insurance of 10103 overall. This means a business can deduct the total cost from its pre-tax profits.

As a result if your car is worth around 40000 you might receive a tax relief of 8400.

Taxation Acea European Automobile Manufacturers Association

The Tax Benefits Of Electric Vehicles Taxassist Accountants

Road Tax Company Tax Benefits On Electric Cars Edf

Electric Car Electric Bill Off 70

The Uptake Of Plug In Hybrid Electric Vehicles In Europe S Company Car Fleets Trends And Policies International Council On Clean Transportation

Electric Vehicles Face Lingering Challenges How Are Startups Helping Early Metrics

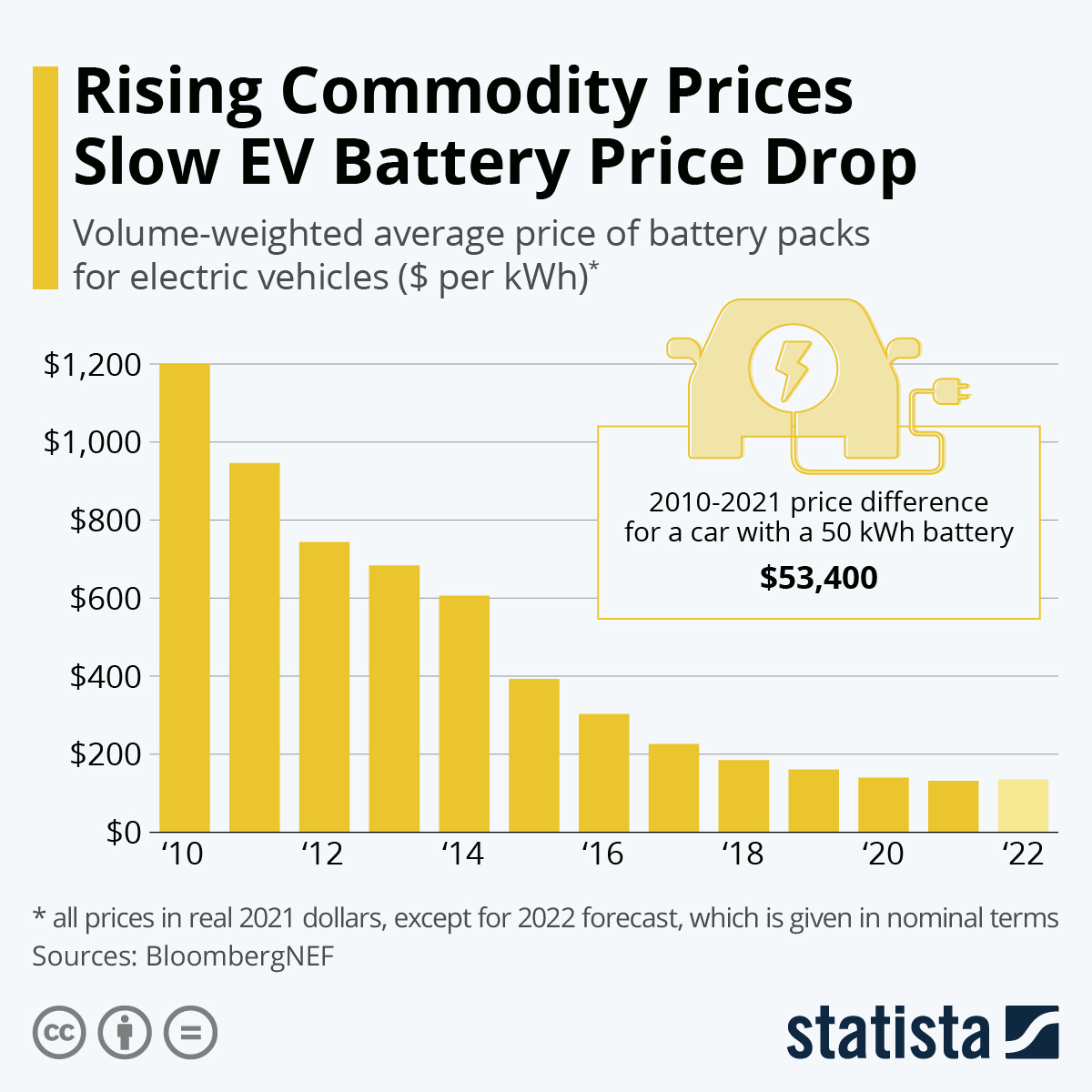

Electric Cars Will Be Cheaper To Produce Than Fossil Fuel Vehicles By 2027 Automotive Industry The Guardian

Why Evs Don T Spell Doom For The Aftermarket

Purchase Subsidies Zero Rate Tax And Toll Free Travel How To Incentivise Emobility Skoda Storyboard

Electric Car Tax Benefits Green Car Guide

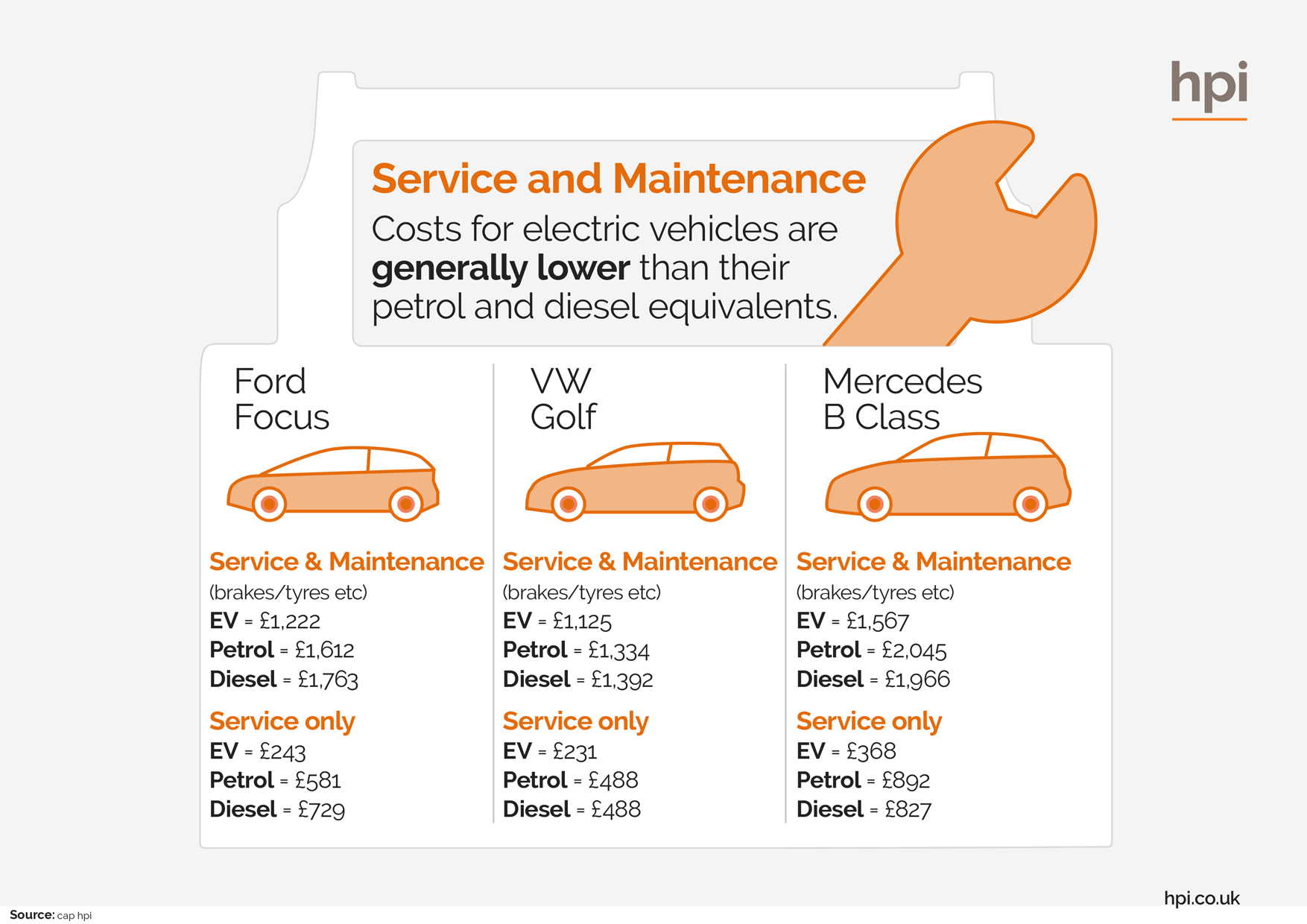

Ev Car Maintenance Cost Off 63

Russia Cancels Import Tax For Electric Cars In Hopes Of Enticing Drivers Bellona Org

Electric Car Electric Bill Off 70

Ev Car Maintenance Cost Off 63

Europe Is Subsidizing Its Way Into Electric Vehicle Leadership Nasdaq

Government Electric Car Grants Save On Your Ev Leasing Options

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

The Tax Benefits Of Electric Vehicles Saffery Champness

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals